Union Budget 2023 : Income Tax Rebate limit increased to Rs 7 lakh from Rs 5 lakh

02-Feb-2023

744

Union Budget 2023 : Income Tax Rebate limit increased to Rs 7 lakh from Rs 5 lakh

-------------------------------------

Navesh Kumar

Sr.journalist.

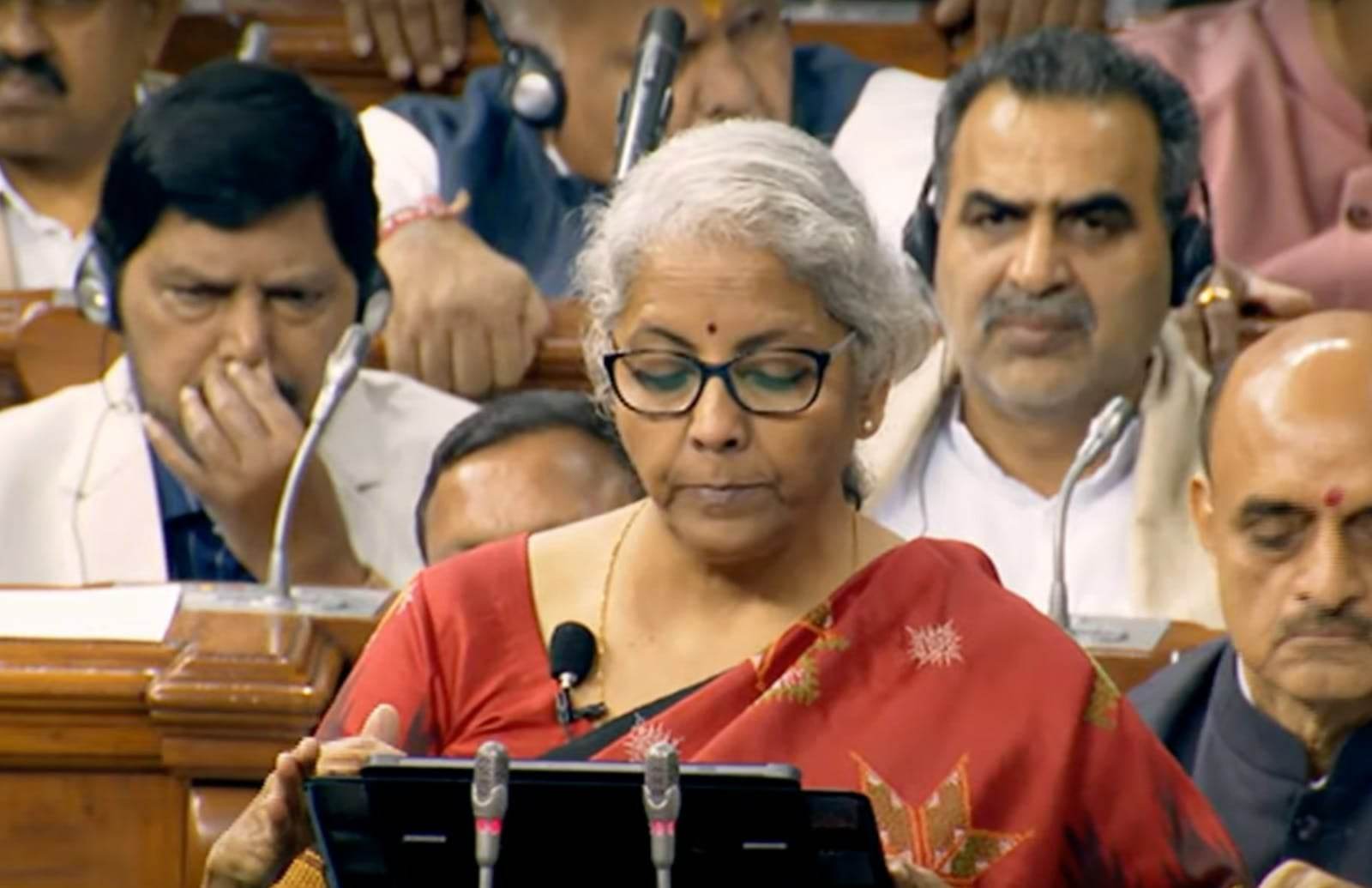

New Delhi,1 Feb 2023 (Agency). Finance Minister Nirmala Sitharaman presented Union budget 2023 in parliament today. Income Tax relief for the salaried class, building digital public infrastructure, setting up a National Digital Library were among the key highlights of the Sitaraman’s speech.

The key highlights of Union Budget 2023

Seven priorities — Saptarishi

The Finance Minister listed seven priorities Saptarishi of Union Budget 2023, Inclusive development, reaching the last mile

Infrastructure and investment, unleashing the potential, Green growth, youth power

financial sector.

Agriculture and cooperatives sector

In Agriculture and cooperative sector the announcement made for –

Building digital public infrastructure. The setting up an agriculture accelerator fund. Making India the global hub for millets and setting up more storage capacity for farmers.

Education

District Institutes of Education and Training to be developed as vibrant institutes of excellence for Teachers’ Training.A National Digital Library for Children and Adolescents to be set-up for facilitating availability of quality books across geographies, languages, genres and levels, and device agnostic accessibility. The settingup physical libraries for them at panchayat and ward levels

Health

Sickle cell Anemia elimination mission to be launched, 157 new nursing college to be established.Joint public and Private medical research to be encouraged.New programmes to promote research in pharmauticals.The budget estimate for the Ministry of Electronics and Information Technology -increased to Rs 16, 549.04 crore from the Rs 11,719.95 crore.

New income tax slab

Under the new personal tax regime, six income tax slabs have been reduced to six. The government has also increased the tax exemption limits in some of these categories.0-3 lakh- nil, 3-6 lakh -5% 6-9 lakh – 10%, 9-12 lakh-15%, 12-15 lakh -20%

Above 15 lakh – 30%.

Saving Scheme for Senior Citizen

Government to double the deposit limit for Senior Citizen Savings Scheme to Rs 30 lakh and Monthly Income Account Scheme to Rs 9 lakh.The maximum deposit limit for Monthly Income Account Scheme will be enhanced from Rs 4.5 lakh to Rs 9 lakh for a single account and from Rs 9 lakh to Rs 15 lakh for a joint account.

Expensive and cheaper (Taxes)

Customs duty on parts of open cells of TV panels cut to 2.5 per cent.customs duty on import of certain inputs for mobile phone manufacturing to be reduced.Basic customs duty on seeds used in manufacturing of lab-grown diamond to be reduced. customs duty on shrimp feed to promote exports to be reduced.

Basic customs duty increased on articles made from gold bars.Customs duty hiked on kitchen electric chimney from to 15 percent.16 percent hike on Taxes on cigarettes hiked by 16 per cent

Basic import duty on compounded rubber increased to 25 per cent from 10 per cent.L.S.

Write to Diya Mali

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.jpg)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)